- Home

- Urdu Books

- Children's Urdu Books

- Business & Management

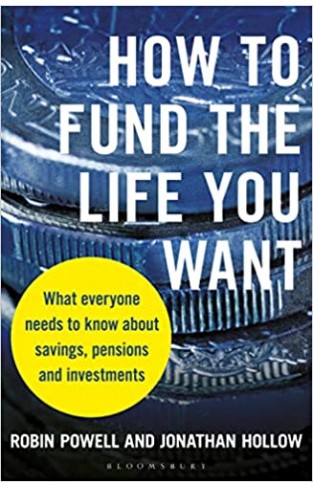

- How to Fund the Life You Want - What Everyone Needs to Know about Savings, Pensions and Investments

How to Fund the Life You Want - What Everyone Needs to Know about Savings, Pensions and Investments

By: Robin Powell

-

Rs 2,726.75

- Rs 4,195.00

- 35%

You save Rs 1,468.25.

Due to constant currency fluctuation, prices are subject to change with or without notice.

More and more people are reassessing their lives as a result of the pandemic. Many have left their jobs or reduced their hours. Others have resolved to work only as long as they must, retiring early to focus on families and friends, hobbies or travel. Meanwhile, employers all over the world are experimenting with a four-day week.

Making the most of these choices requires having and growing enough money to enjoy your future life, without needing to worry about it running out. But when it comes to investing in a pension, there is a dizzying number of complex options available.

This book is designed to provide clear, objective guidance that cuts through the jargon, giving you control over your financial future. The authors strip away the marketing-speak, and through simple graphs, charts and diagrams, provide an evidence-based money manual that you can use again and again. They also alert you to myths and get-rich-quick schemes everyone should avoid.

It's a highly practical and refreshingly honest book, written by two independent experts who have seen how the investment industry works from the inside, and how it profits from complexity, ignorance and fear. They show, in practical language, how UK savers and investors can beat this system and, crucially, make more money for themselves than they do for financial services firms.

More and more people are reassessing their lives as a result of the pandemic. Many have left their jobs or reduced their hours. Others have resolved to work only as long as they must, retiring early to focus on families and friends, hobbies or travel. Meanwhile, employers all over the world are experimenting with a four-day week.

Making the most of these choices requires having and growing enough money to enjoy your future life, without needing to worry about it running out. But when it comes to investing in a pension, there is a dizzying number of complex options available.

This book is designed to provide clear, objective guidance that cuts through the jargon, giving you control over your financial future. The authors strip away the marketing-speak, and through simple graphs, charts and diagrams, provide an evidence-based money manual that you can use again and again. They also alert you to myths and get-rich-quick schemes everyone should avoid.

It's a highly practical and refreshingly honest book, written by two independent experts who have seen how the investment industry works from the inside, and how it profits from complexity, ignorance and fear. They show, in practical language, how UK savers and investors can beat this system and, crucially, make more money for themselves than they do for financial services firms.

How to Fund the Life You Want - What Everyone Needs to Know about Savings, Pensions and Investments

By: Robin Powell

Rs 2,726.75 Rs 4,195.00 Ex Tax :Rs 2,726.75

Invest Your Way to Financial Freedom: A simple guide to everything you need to know

By: Robin Powell

Rs 2,527.25 Rs 4,595.00 Ex Tax :Rs 2,527.25

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

The Black Swan The Impact Of The Highly Improbable

By: Nassim Nicholas Taleb

Rs 2,636.00 Rs 3,295.00 Ex Tax :Rs 2,636.00

Beyond The Crash: Overcoming The First Crisis Of Globalisation

By: Gordon Brown

Rs 316.00 Rs 395.00 Ex Tax :Rs 316.00

Reset: How This Crisis Can Restore Our Values and Renew America

By: Kurt Andersen

Rs 400.00 Rs 500.00 Ex Tax :Rs 400.00

Powershift Knowledge Wealth And Violence at the Edge of the 21st Century

By: Alvin Toffler

Rs 1,271.25 Rs 1,695.00 Ex Tax :Rs 1,271.25

High Financier: The Lives And Time Of Siegmund Warburg

By: Niall Ferguson

Rs 1,787.50 Rs 2,750.00 Ex Tax :Rs 1,787.50

Why Smart People Make Big Money Mistakes and How to Correct Them

By: Gary Belsky

Rs 627.75 Rs 1,395.00 Ex Tax :Rs 627.75

Switch: How to change things when change is hard - (PB)

By: Dan Heath

Rs 767.25 Rs 1,395.00 Ex Tax :Rs 767.25

No similar books from this author available at the moment.

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

How to Fund the Life You Want - What Everyone Needs to Know about Savings, Pensions and Investments

By: Robin Powell

Rs 2,726.75 Rs 4,195.00 Ex Tax :Rs 2,726.75

Invest Your Way to Financial Freedom: A simple guide to everything you need to know

By: Robin Powell

Rs 2,527.25 Rs 4,595.00 Ex Tax :Rs 2,527.25

-120x187.jpg?q6)