- Home

- Non Fiction

- Business & Management

- Business & Economics

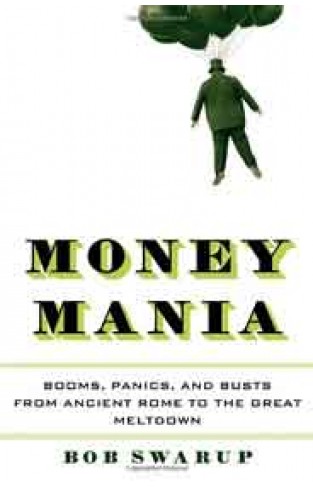

- Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown

Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown

By: Bob Swarup

-

Rs 2,252.50

- Rs 2,650.00

- 15%

You save Rs 397.50.

Due to constant currency fluctuation, prices are subject to change with or without notice.

| Book | |

| What's in the Box? | 1 x Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown |

Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown

By: Bob Swarup

Rs 2,252.50 Rs 2,650.00 Ex Tax :Rs 2,252.50

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 892.50 Rs 1,050.00 Ex Tax :Rs 892.50

The 10 Trillion Prize Captivating thely Affluent in China and India

By: Michael J. Silverstein

Rs 1,865.75 Rs 2,195.00 Ex Tax :Rs 1,865.75

Global Dexterity: How to Adapt Your Behavior Across Cultures without Losing Yourself in the Process

By: Andy Molinsky

Rs 1,950.75 Rs 2,295.00 Ex Tax :Rs 1,950.75

Poor Economics: The Surprising Truth about Life on Less Than $1 a Day

By: Abhijit Banerjee

Rs 2,515.50 Rs 2,795.00 Ex Tax :Rs 2,515.50

The Great Degeneration: How Institutions Decay and Economies Die

By: Niall Ferguson

Rs 2,035.75 Rs 2,395.00 Ex Tax :Rs 2,035.75

Email Revolution : Unleashing The Power To Connect

By: V. A. Shiva Ayyadurai

Rs 862.50 Rs 1,150.00 Ex Tax :Rs 862.50

Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown

By: Bob Swarup

Rs 2,252.50 Rs 2,650.00 Ex Tax :Rs 2,252.50

World 30 Global Prosperity and How To Achieve It

By: Pankaj Ghemawat

Rs 7,305.75 Rs 8,595.00 Ex Tax :Rs 7,305.75

No similar books from this author available at the moment.

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 892.50 Rs 1,050.00 Ex Tax :Rs 892.50

Money Mania Booms Panics and Busts from Ancient Rome to the Great Meltdown

By: Bob Swarup

Rs 2,252.50 Rs 2,650.00 Ex Tax :Rs 2,252.50

-120x187.jpg?q6)