- Home

- Non Fiction

- Biography/Autobiography

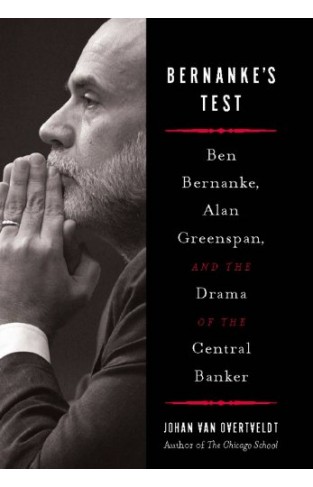

- Bernanke's Test - Ben Bernanke, Alan Greenspan, and the Drama of the Central Banker

Bernanke's Test - Ben Bernanke, Alan Greenspan, and the Drama of the Central Banker

By: Johan Van Overtveldt

-

Rs 597.00

- Rs 995.00

- 40%

You save Rs 398.00.

Due to constant currency fluctuation, prices are subject to change with or without notice.

Bernanke's Test - Ben Bernanke, Alan Greenspan, and the Drama of the Central Banker

By: Johan Van Overtveldt

Rs 597.00 Rs 995.00 Ex Tax :Rs 597.00

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 525.00 Rs 1,050.00 Ex Tax :Rs 525.00

Flying Blind - The 737 MAX Tragedy and the Fall of Boeing

By: Peter Robison

Rs 2,021.25 Rs 2,695.00 Ex Tax :Rs 2,021.25

Born To Dare The Life Of Lt Gen Inderjit Singh Gill Pvsm Mc

By: William Smethurst

Rs 626.50 Rs 895.00 Ex Tax :Rs 626.50

Manning Up: How the Rise of Women Has Turned Men into Boys

By: Kay Hymowitz

Rs 746.25 Rs 995.00 Ex Tax :Rs 746.25

Flying Blind - The 737 MAX Tragedy and the Fall of Boeing

By: Peter Robison

Rs 2,021.25 Rs 2,695.00 Ex Tax :Rs 2,021.25

Born To Dare The Life Of Lt Gen Inderjit Singh Gill Pvsm Mc

By: William Smethurst

Rs 626.50 Rs 895.00 Ex Tax :Rs 626.50

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 525.00 Rs 1,050.00 Ex Tax :Rs 525.00

Bernanke's Test - Ben Bernanke, Alan Greenspan, and the Drama of the Central Banker

By: Johan Van Overtveldt

Rs 597.00 Rs 995.00 Ex Tax :Rs 597.00

Flying Blind - The 737 MAX Tragedy and the Fall of Boeing

By: Peter Robison

Rs 2,021.25 Rs 2,695.00 Ex Tax :Rs 2,021.25

Born To Dare The Life Of Lt Gen Inderjit Singh Gill Pvsm Mc

By: William Smethurst

Rs 626.50 Rs 895.00 Ex Tax :Rs 626.50

-120x187.jpg?q6)