- Home

- Categories

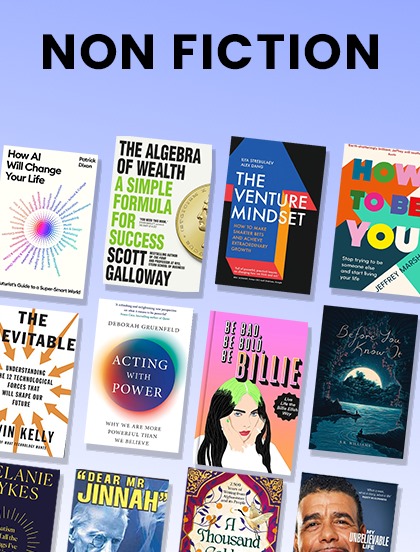

- Non Fiction

- Business & Management

- Entrepreneurship & Business Strategy

- The Behavioral Investor

The Behavioral Investor

By: Daniel Crosby

-

Rs 985.50

- Rs 1,095.00

- 10%

You save Rs 109.50.

Due to constant currency fluctuation, prices are subject to change with or without notice.

The Art and Science of Investment Management

THE BEHAVIORAL INVESTOR aims to enrich readers in the most holistic sense of the word, leaving them with tools for compounding both wealth and knowledge.

Wealth, truly considered, has at least as much to do with psychological as financial wellbeing. In The Behavioral Investor, psychologist and asset manager Daniel Crosby examines the sociological, neurological and psychological factors that influence our investment decisions and sets forth practical solutions for improving both returns and behavior.

Readers will be treated to the most comprehensive examination of investor behavior to date and will leave with concrete solutions for refining decision-making processes, increasing self-awareness and constraining the fatal flaws to which most investors are prone.

THE BEHAVIORAL INVESTOR takes a sweeping tour of human nature before arriving at the specifics of portfolio construction, rooted in the belief that it is only as we come to a deep understanding of “why” that we are left with any clue as to “how” we ought to invest.

DANIEL CROSBY is a psychologist, behavioral finance expert and asset manager who applies his study of market psychology to everything from financial product design to security selection. He is a New York Times bestselleing author and founder of Nocturne Capital. He is at the forefront of behavioralising finance.

The Art and Science of Investment Management

THE BEHAVIORAL INVESTOR aims to enrich readers in the most holistic sense of the word, leaving them with tools for compounding both wealth and knowledge.

Wealth, truly considered, has at least as much to do with psychological as financial wellbeing. In The Behavioral Investor, psychologist and asset manager Daniel Crosby examines the sociological, neurological and psychological factors that influence our investment decisions and sets forth practical solutions for improving both returns and behavior.

Readers will be treated to the most comprehensive examination of investor behavior to date and will leave with concrete solutions for refining decision-making processes, increasing self-awareness and constraining the fatal flaws to which most investors are prone.

THE BEHAVIORAL INVESTOR takes a sweeping tour of human nature before arriving at the specifics of portfolio construction, rooted in the belief that it is only as we come to a deep understanding of “why” that we are left with any clue as to “how” we ought to invest.

DANIEL CROSBY is a psychologist, behavioral finance expert and asset manager who applies his study of market psychology to everything from financial product design to security selection. He is a New York Times bestselleing author and founder of Nocturne Capital. He is at the forefront of behavioralising finance.

The Laws of Wealth: Psychology and the Secret to Investing Success

By: Daniel Crosby

Rs 3,676.00 Rs 4,595.00 Ex Tax :Rs 3,676.00

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 630.00 Rs 1,050.00 Ex Tax :Rs 630.00

Losing My Virginity: The Autobiography

By: Sir Richard Branson

Rs 2,605.50 Rs 2,895.00 Ex Tax :Rs 2,605.50

The Lean Startup How Constant Innovation Creates Radically Successful Businesses

By: Eric Ries

Rs 3,795.00 Ex Tax :Rs 3,795.00

How To Start a Busines Without Any Money

By: Rachel Bridge

Rs 2,476.00 Rs 3,095.00 Ex Tax :Rs 2,476.00

Private Label Strategy How to Meet the Store Brand Challenge

By: Nirmalya Kumar

Rs 2,065.50 Rs 2,295.00 Ex Tax :Rs 2,065.50

The First Mile A Launch Manual for Getting Great Ideas into the Market

By: Scott D. Anthony

Rs 1,377.00 Rs 2,295.00 Ex Tax :Rs 1,377.00

The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers

By: Ben Horowitz

Rs 4,895.00 Ex Tax :Rs 4,895.00

Leading Strategic Change: Bridging Theory and Practice

By: Eric Flamholtz & Yvonne Randle

Rs 477.00 Rs 795.00 Ex Tax :Rs 477.00

Nadella: The Changing Face of Microsoft

By: Jagmohan S. Bhanver

Rs 265.50 Rs 295.00 Ex Tax :Rs 265.50

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 630.00 Rs 1,050.00 Ex Tax :Rs 630.00

The Laws of Wealth: Psychology and the Secret to Investing Success

By: Daniel Crosby

Rs 3,676.00 Rs 4,595.00 Ex Tax :Rs 3,676.00

-120x187.jpg?q6)