- Home

- Categories

- Fiction

- Historical Fiction

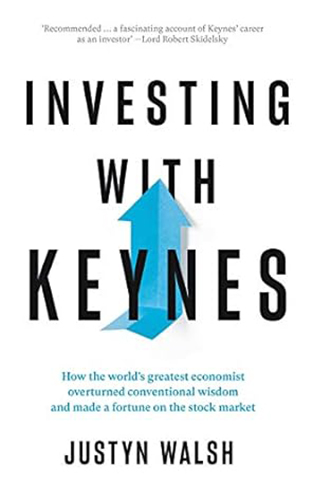

- Investing with Keynes; How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market

Investing with Keynes; How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market

By: Justyn Walsh

-

Rs 2,245.50

- Rs 2,495.00

- 10%

You save Rs 249.50.

Due to constant currency fluctuation, prices are subject to change with or without notice.

Before there was Warren Buffett, there was John Maynard Keynes

John Maynard Keynes was a many-sided figure - world-changing economist, architect of the post-War international monetary system, bestselling author, a baron in the House of Lords, and key member of the fabled Bloomsbury group.

He was also one of that rare breed who mastered the financial markets in practice as well as in theory - an expert stock picker and star fund manager, Keynes made vast sums of money both on his own account and for the college endowment fund he managed.

Keynes' investment principles, refined over decades of investing, represent a straightforward and time-tested framework for exploiting the periodic irrationality of stock markets. In today's era of profound uncertainty and volatility, the insights of Keynes - a man who lived and prospered through two world wars, the Crash of 1929, and the Great Depression - are more relevant than ever.

This accessible and informative book identifies what modern masters of the market have taken from Keynes and used in their own investing styles - and what you too can learn from one of the greatest thinkers of the twentieth century.

Before there was Warren Buffett, there was John Maynard Keynes

John Maynard Keynes was a many-sided figure - world-changing economist, architect of the post-War international monetary system, bestselling author, a baron in the House of Lords, and key member of the fabled Bloomsbury group.

He was also one of that rare breed who mastered the financial markets in practice as well as in theory - an expert stock picker and star fund manager, Keynes made vast sums of money both on his own account and for the college endowment fund he managed.

Keynes' investment principles, refined over decades of investing, represent a straightforward and time-tested framework for exploiting the periodic irrationality of stock markets. In today's era of profound uncertainty and volatility, the insights of Keynes - a man who lived and prospered through two world wars, the Crash of 1929, and the Great Depression - are more relevant than ever.

This accessible and informative book identifies what modern masters of the market have taken from Keynes and used in their own investing styles - and what you too can learn from one of the greatest thinkers of the twentieth century.

Investing with Keynes; How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market

By: Justyn Walsh

Rs 2,245.50 Rs 2,495.00 Ex Tax :Rs 2,245.50

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 630.00 Rs 1,050.00 Ex Tax :Rs 630.00

The Quest For Meaning: Developing A Philosophy Of Pluralism

By: Tariq Ramadan

Rs 1,255.50 Rs 1,395.00 Ex Tax :Rs 1,255.50

The Basic Writings of Nietzsche

By: Peter Gay/Sigmund Freud

Rs 3,775.50 Rs 4,195.00 Ex Tax :Rs 3,775.50

No similar books from this author available at the moment.

Pharmanomics How Big Pharma Destroys Global Health

By: Nick Dearden

Rs 4,956.00 Rs 6,195.00 Ex Tax :Rs 4,956.00

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 630.00 Rs 1,050.00 Ex Tax :Rs 630.00

Investing with Keynes; How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market

By: Justyn Walsh

Rs 2,245.50 Rs 2,495.00 Ex Tax :Rs 2,245.50

-120x187.jpg?q6)