- Home

- Business & Management

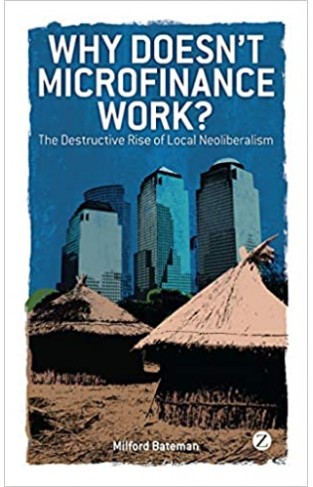

- Why Doesn't Microfinance Work? - The Destructive Rise of Local Neoliberalism

Why Doesn't Microfinance Work? - The Destructive Rise of Local Neoliberalism

By: Milford Bateman

-

Rs 2,762.50

- Rs 3,250.00

- 15%

You save Rs 487.50.

Due to constant currency fluctuation, prices are subject to change with or without notice.

Why Doesn't Microfinance Work? - The Destructive Rise of Local Neoliberalism

By: Milford Bateman

Rs 2,762.50 Rs 3,250.00 Ex Tax :Rs 2,762.50

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 892.50 Rs 1,050.00 Ex Tax :Rs 892.50

The Chastening: Inside the Crisis That Rocked the Global Financial System and Humbled the IMF

By: Paul Blustein

Rs 1,196.00 Rs 2,990.00 Ex Tax :Rs 1,196.00

The Origins of Political Order From Prehuman Times to the French RevolutioN

By: Francis Fukuyama

Rs 4,045.50 Rs 4,495.00 Ex Tax :Rs 4,045.50

The Chastening: Inside the Crisis That Rocked the Global Financial System and Humbled the IMF

By: Paul Blustein

Rs 1,196.00 Rs 2,990.00 Ex Tax :Rs 1,196.00

Outsmart Your Brain - Why Learning is Hard and How You Can Make It Easy

By: Daniel Willingham

Rs 4,245.75 Rs 4,995.00 Ex Tax :Rs 4,245.75

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 892.50 Rs 1,050.00 Ex Tax :Rs 892.50

Why Doesn't Microfinance Work? - The Destructive Rise of Local Neoliberalism

By: Milford Bateman

Rs 2,762.50 Rs 3,250.00 Ex Tax :Rs 2,762.50

The Chastening: Inside the Crisis That Rocked the Global Financial System and Humbled the IMF

By: Paul Blustein

Rs 1,196.00 Rs 2,990.00 Ex Tax :Rs 1,196.00

-120x187.jpg?q6)

-120x187.jpg?q6)

-120x187.jpg?q6)