- Home

- Books

- Categories

- Non Fiction

- Business & Management

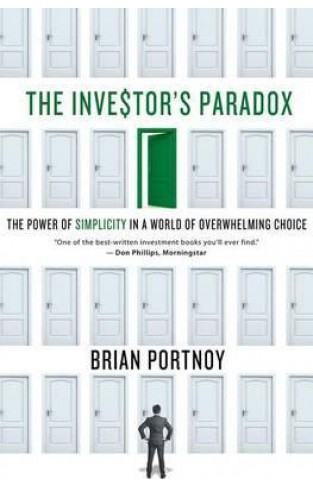

- The Investor's Paradox : The Power of Simplicity in a World of Overwhelming Choice

The Investor's Paradox : The Power of Simplicity in a World of Overwhelming Choice

By: Brian Portnoy

-

Rs 7,121.25

- Rs 9,495.00

- 25%

You save Rs 2,373.75.

Due to constant currency fluctuation, prices are subject to change with or without notice.

We're all familiar with "choice overload," whether on a trip to the grocery store, or while flipping through satellite TV channels. And while it's human to want all of the options, the surprising truth is that the more choice we have, the less satisfied we are. And nowhere is this more true - or more dangerous - than in our investments. Despite the troubled global economy, there are tens of thousands of mutual funds, hedge funds, exchange-traded funds, and other vehicles waiting to take your money. For help, individual and institutional investors alike turn to financial managers, though they are often no better equipped than the average person to assess and manage risk. In The Investor's Paradox, hedge fund expert Brian Portnoy explains how to sift through today's diverse investment choices and solve even the most daunting portfolio problems. Drawing on cutting-edge research in behavioral economics, social psychology and choice theory, Portnoy lays bare the biases that interfere with good decision-making, and gives readers a set of basic tools they can use to tell the good from the bad.

Along the way, he demystifies hedge funds, cuts through the labyrinth of the modern financial supermarket, and debunks popular myths, including the idea that mutual funds can "beat the market."

We're all familiar with "choice overload," whether on a trip to the grocery store, or while flipping through satellite TV channels. And while it's human to want all of the options, the surprising truth is that the more choice we have, the less satisfied we are. And nowhere is this more true - or more dangerous - than in our investments. Despite the troubled global economy, there are tens of thousands of mutual funds, hedge funds, exchange-traded funds, and other vehicles waiting to take your money. For help, individual and institutional investors alike turn to financial managers, though they are often no better equipped than the average person to assess and manage risk. In The Investor's Paradox, hedge fund expert Brian Portnoy explains how to sift through today's diverse investment choices and solve even the most daunting portfolio problems. Drawing on cutting-edge research in behavioral economics, social psychology and choice theory, Portnoy lays bare the biases that interfere with good decision-making, and gives readers a set of basic tools they can use to tell the good from the bad.

Along the way, he demystifies hedge funds, cuts through the labyrinth of the modern financial supermarket, and debunks popular myths, including the idea that mutual funds can "beat the market."

The Investor's Paradox : The Power of Simplicity in a World of Overwhelming Choice

By: Brian Portnoy

Rs 7,121.25 Rs 9,495.00 Ex Tax :Rs 7,121.25

How I Invest My Money: Finance Experts Reveal how They Save, Spend, and Invest

By: Brian Portnoy

Rs 3,766.75 Rs 5,795.00 Ex Tax :Rs 3,766.75

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

A Political History of the World - Three Thousand Years of War and Peace

By: Jonathan Holslag

Rs 3,145.50 Rs 3,495.00 Ex Tax :Rs 3,145.50

Myths Illusions and Peace: Finding a New Direction for America in the Middle East

By: Dennis Ross

Rs 985.50 Rs 1,095.00 Ex Tax :Rs 985.50

The Origins of Political Order From Prehuman Times to the French RevolutioN

By: Francis Fukuyama

Rs 3,505.50 Rs 3,895.00 Ex Tax :Rs 3,505.50

Manning Up: How the Rise of Women Has Turned Men into Boys

By: Kay Hymowitz

Rs 646.75 Rs 995.00 Ex Tax :Rs 646.75

The Obama Syndrome: Surrender At Home War Abroad

By: Tariq Ali

Rs 1,165.50 Rs 1,295.00 Ex Tax :Rs 1,165.50

The Quest For Meaning: Developing A Philosophy Of Pluralism

By: Tariq Ramadan

Rs 1,255.50 Rs 1,395.00 Ex Tax :Rs 1,255.50

A Political History of the World - Three Thousand Years of War and Peace

By: Jonathan Holslag

Rs 3,145.50 Rs 3,495.00 Ex Tax :Rs 3,145.50

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

The Investor's Paradox : The Power of Simplicity in a World of Overwhelming Choice

By: Brian Portnoy

Rs 7,121.25 Rs 9,495.00 Ex Tax :Rs 7,121.25

How I Invest My Money: Finance Experts Reveal how They Save, Spend, and Invest

By: Brian Portnoy

Rs 3,766.75 Rs 5,795.00 Ex Tax :Rs 3,766.75

A Political History of the World - Three Thousand Years of War and Peace

By: Jonathan Holslag

Rs 3,145.50 Rs 3,495.00 Ex Tax :Rs 3,145.50

-120x187.jpg?q6)

-120x187.jpg?q6)