- Home

- Books

- Categories

- Non Fiction

- Business & Management

- Finance, Investment & Stocks

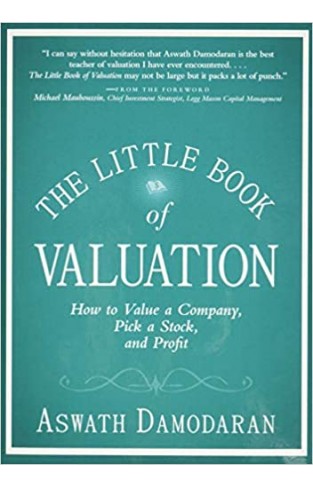

- The Little Book of Valuation – How to Value a Company, Pick a Stock, and Profit: 34 (Little Books. Big Profits)

The Little Book of Valuation – How to Value a Company, Pick a Stock, and Profit: 34 (Little Books. Big Profits)

By: Aswath Damodaran

-

Rs 10,345.50

- Rs 11,495.00

- 10%

You save Rs 1,149.50.

Due to constant currency fluctuation, prices are subject to change with or without notice.

The Little Book of Valuation – How to Value a Company, Pick a Stock, and Profit: 34 (Little Books. Big Profits)

By: Aswath Damodaran

Rs 10,345.50 Rs 11,495.00 Ex Tax :Rs 10,345.50

The Little Book of Valuation - How to Value a Company, Pick a Stock, and Profit

By: Aswath Damodaran

Rs 12,325.50 Rs 13,695.00 Ex Tax :Rs 12,325.50

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

The Things You Can See Only When You Slow Down: How to be Calm in a Busy World

By: Haemin Sunim

Rs 2,515.50 Rs 2,795.00 Ex Tax :Rs 2,515.50

The Snowball: Warren Buffett and the Business of Life

By: Alice Schroeder

Rs 3,146.25 Rs 4,195.00 Ex Tax :Rs 3,146.25

The Tao of Warren Buffett - Warren Buffett's Words of Wisdom

By: Mary Buffett & David Clark

Rs 2,425.50 Rs 2,695.00 Ex Tax :Rs 2,425.50

The Little Book of Common Sense Investing - The Only Way to Guarantee Your Fair Share of Stock Market Returns

By: John C. Bogle

Rs 8,815.50 Rs 9,795.00 Ex Tax :Rs 8,815.50

Chasing Stars: The Myth of Talent and the Portability of Performance

By: Boris Groysberg

Rs 5,456.75 Rs 8,395.00 Ex Tax :Rs 5,456.75

Tactics: 10 Success Strategies for Young Professionals

By: Jan Zuchowski

Rs 906.75 Rs 1,395.00 Ex Tax :Rs 906.75

The Art of Asking: How I learned to stop worrying and let people help

By: Amanda Palmer

Rs 697.50 Rs 1,550.00 Ex Tax :Rs 697.50

Martensitic Transformations

By: V A Lobodyuk, E I Estrin

Rs 1,788.75 Rs 3,975.00 Ex Tax :Rs 1,788.75

American Dreams : Restarting the Economy and Restoring the Land of Opportunity

By: Marco Rubio

Rs 1,077.75 Rs 2,395.00 Ex Tax :Rs 1,077.75

Picture Your Prosperity: Smart Money Moves to Turn Your Vision Into Reality

By: Ellen Rogin

Rs 547.25 Rs 995.00 Ex Tax :Rs 547.25

Population and Development: The Demographic Transition

By: Tim Dyson

Rs 1,302.75 Rs 2,895.00 Ex Tax :Rs 1,302.75

The Things You Can See Only When You Slow Down: How to be Calm in a Busy World

By: Haemin Sunim

Rs 2,515.50 Rs 2,795.00 Ex Tax :Rs 2,515.50

The Snowball: Warren Buffett and the Business of Life

By: Alice Schroeder

Rs 3,146.25 Rs 4,195.00 Ex Tax :Rs 3,146.25

The Tao of Warren Buffett - Warren Buffett's Words of Wisdom

By: Mary Buffett & David Clark

Rs 2,425.50 Rs 2,695.00 Ex Tax :Rs 2,425.50

The Little Book of Common Sense Investing - The Only Way to Guarantee Your Fair Share of Stock Market Returns

By: John C. Bogle

Rs 8,815.50 Rs 9,795.00 Ex Tax :Rs 8,815.50

No recently viewed books available at the moment.

Zubin Mehta: A Musical Journey (An Authorized Biography)

By: VOID - Bakhtiar K. Dadabhoy

Rs 472.50 Rs 1,050.00 Ex Tax :Rs 472.50

The Little Book of Valuation – How to Value a Company, Pick a Stock, and Profit: 34 (Little Books. Big Profits)

By: Aswath Damodaran

Rs 10,345.50 Rs 11,495.00 Ex Tax :Rs 10,345.50

The Little Book of Valuation - How to Value a Company, Pick a Stock, and Profit

By: Aswath Damodaran

Rs 12,325.50 Rs 13,695.00 Ex Tax :Rs 12,325.50

The Things You Can See Only When You Slow Down: How to be Calm in a Busy World

By: Haemin Sunim

Rs 2,515.50 Rs 2,795.00 Ex Tax :Rs 2,515.50

The Snowball: Warren Buffett and the Business of Life

By: Alice Schroeder

Rs 3,146.25 Rs 4,195.00 Ex Tax :Rs 3,146.25

The Tao of Warren Buffett - Warren Buffett's Words of Wisdom

By: Mary Buffett & David Clark

Rs 2,425.50 Rs 2,695.00 Ex Tax :Rs 2,425.50

The Little Book of Common Sense Investing - The Only Way to Guarantee Your Fair Share of Stock Market Returns

By: John C. Bogle

Rs 8,815.50 Rs 9,795.00 Ex Tax :Rs 8,815.50

-120x187.jpg?q6)